One of the most important metrics your business needs to understand is the cost of customer acquisition or CAC.

Understanding what it costs your company to acquire a new customer can be like looking into a crystal ball that can measure whether your company is destined to fail or succeed.

It can also help point you in the right direction as to where to spend your time, money and marketing efforts.

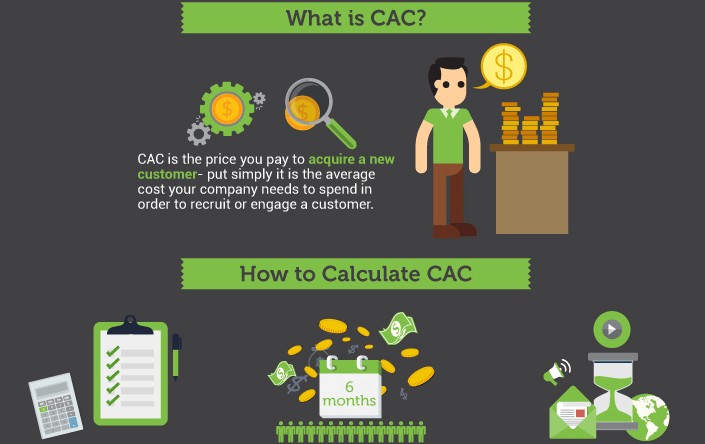

What is CAC?

CAC is the price you pay to acquire a new customer- put simply it is the average cost your company needs to spend in order to recruit or engage a customer.

Before we continue, it is important to understand that CAC is not the same as cost per action (CPA). In e-commerce, CPA is the amount it takes for you to convert a customer old or new, whereas CAC is about how much it costs you to just get a new customer.

CAC is about acquiring new customers whereas CPA is really the cost you are willing to invest in order to make a conversion, not to acquire a new customer.

Understanding your CAC can help you to scale your business, boost profits, cut costs and enhance your marketing strategies. Investors also heavily rely on CAC to determine whether a business is profitable, even in the startup phase.

How to Calculate CAC

The easiest way to understand your CAC is to calculate all the costs spent on acquiring new customers, such as marketing etc. and then divide it by the number of customers acquired.

For example, say in 6 months your company spent $50,000 on marketing, sales, relevant wages, overheads etc. and during that time you acquired 15,000 customers. This would mean that your CAC would be $3.33

This is an effective way to start understanding how much it costs your company to recruit a customer. Of course, this calculation is only the beginning and can be more complex depending on different factors in your business model.

Studies have actually found that most businesses underestimate the cost of customer acquisition because they forget to factor in time spent on social media outreach, emails, networking and sales calls. Use your best judgement to factor in all the day to day, big or small costs it takes to obtain a customer in order to get the most accurate portrayal of your CAC.

Alongside your CAC is another very important metric – the Customer Lifetime Value (CLV), this is because your CAC doesn’t really stand for much without understanding the life time value of your customers and how likely they are to purchase again.

Taking the data from the example above, a $3.33 CAC sounds appealing, but what if the product is only a .99 cent app, which customers are never likely to purchase again?

This CAC would mean the company is essentially making a huge loss due to the fact that they are investing far more than they are getting in return. The only exception here would be if the app was generating a higher CLV from services such as in-app advertising or purchases.

This is where CAC can become a little more complex and involved but basically, a good rule of thumb is that you want your CAC and your Customer Lifetime Value to be in a balanced ratio of 3:1 (CLV:CAC).

If your ratio is lower than that (1:1), your business could be in a very precarious place and if it’s higher than that (4:1), it could be that you are under investing and need to start a more aggressive campaign.

Your CLV is basically a prediction of the net profit that your company will make through the entire future relationship with each customer. It is determined by averaging out the cost that each customer typically spends.

To quickly calculate your CLV, take the revenue you earn from each customer, subtract the money spent on acquiring them and then adjust all of the payments for time value of money. If this sounds confusing, it is because it is! There are however, plenty of online tools that can help you easily determine your CLV.

Using the example above, let’s say the average CLV is $10 from in-app purchases. This means that for every $3.33 spent (CAC), the app generates an average of $10 in revenue.

From this calculation you can then determine how much revenue you are likely to generate when you spend a certain amount on marketing and whether you need to down-scale or up-scale.

CAC and Marketing

As a marketer, understanding your CAC is important but understanding your CAC for each of your marketing channels is crucial.

Knowing which marketing campaign is yielding you the lowest and highest CAC is going to help you get a better understanding of where to allocate your marketing budget and where your time and energy is better spent.

Start by breaking down each of your campaigns and the cost for each. When doing these calculation you may also have to factor in the time and wages spent on each campaign. Then, work out how many customers were acquired through each of the campaigns to determine your CAC.

Once you have broken down all the costs for each campaign, group them into the different channels that your company uses for example,- Pay Per Click (PPC), Inbound Marketing and Events.

You can then determine the CAC for each marketing channel and determine which is a better fit for your company in terms of attracting and converting customers.

If you sell physical products, it may also be beneficial to factor in your conversions to determine how your PPC campaigns are doing relative to your marketing budget. This is usually easy to determine as many advertising platforms already provide this data.

You may also want to set up software to trace your customers back to their last attribution source. This allows you to see the last channel that your customer visited before doing their first sale with your company. This gives you the ability to understand which marketing strategy is most effective.

For example, using the previous app example, lets say 5% of potential customers who saw an ad on Facebook ended up purchasing the app whereas, only .8% of potential customers who saw the app on an organic search (SEO) ended up purchasing the app.

This would show that more of the budget could be used towards Facebook advertising instead of SEO….right? Well, this can be a bit of a grey area.

Some marketers believe that all marketing channels work synergistically, so Facebook supports SEO and vice versa. This has been proven in traditional media campaigns where having both a TV ad and a radio ad can increase conversion and acquisition rates, however with e-commerce the trends are not always the same.

While most channels do support each other to some extent, when you are able to break down the investment costs and determine trends and patters, it could help you spend your budget more effectively. It is not necessary to remove one channel altogether but it could be beneficial to move a percentage of the budget into another area.

Determining the best way to spend your marketing budget based on the CAC for each marketing channel may seem tedious and complex, especially if you know you have a cross over with certain channels, but it can really help you to get a better understanding of your company’s potential to build revenue and profits.

Ultimately, it comes down to your unique business needs, trial and error and what your company’s philosophy is on advertising and customer acquisition.

How to Improve CAC

Would you like to decrease your CAC?

Of course you would!

Garnering the perfect CAC can take some tweaking but there are ways you can improve your numbers and extract more value from your customers. (No matter how good you think your CAC is….)

Here are just a few suggestions to get you started:

1.) Conversion Metrics: Remember that on it’s own CAC doesn’t count for much. When paired with your CLV however, your CAC means a whole lot more. When you increase your conversion rate on your site, you automatically improve your CAC to CLV ratio. Consider tweaking your landing page, mobile site, site speed, call to actions and more. Try to also navigate where you are loosing customers in your sales funnel to determine where you can make the most necessary improvements.

2.) User Value: This is the ability to generate something that will engage your customers in order to keep them interested and responsive with your company. Customer satisfaction and high audience engagement often leads to more sales, so why not focus on the little things you can do to make your customers happier? This could be starting a blog, offering a free e-book or consultation, running competitions, surveys and more. You may also want to consider ways to engage your existing customers as well by offering them a weekly newsletter, discount coupons and add ons to their existing purchases.

3.) CRM tools: Customer relationship management (CRM) software is used by nearly all successful companies and if you don’t have a platform installed, you are definitely doing your business and brand a disservice. There are plenty of great CRM tools on the market and choosing one will really depend on your unique business needs. When you have your software in place however, you can track all sorts of features about your customers that can help you improve retention, CLV and overall sales.

Understanding your CAC and CLV can help you to not only run a smoother and higher functioning business but it can also help you to increase your ROI.

If you would like helping determining your CAC and which marketing strategies are working best for your company, why not contact us?

Hey!

It looks like you're browsing in . Would you like to switch over to the website?