Pricing; it’s something that is as equally important to the business as it is to the customer.

Are your items priced right?

Naming a price can be one of the hardest decisions you have to make when it comes to setting up your business and often there are many other factors to consider other than just expenses and earnings.

Whether your business is online or brick and mortar, it needs a solid pricing strategy that will help maximise your sales and establish your brand.

Pricing strategy is crucial for two main reasons:

1.) It can help attract customers and set you apart from the competition

2.) It helps your business to stay profitable and to grow

Deciding what price to sell your goods and services really comes down to some tried and true techniques as well as some unique factors that only you, as the business owner can determine.

However, here are eight questions to ask yourself before you even start talking prices:

- Who is your target audience? What price is your target audience willing to pay for your goods or services?

- How do you want to compete with similar businesses- do you want to offer a more high end experience or a more budget friendly one?

- What is the suggested retail price of your products as dictated by the manufacturer or supplier?

- What is the average going rate for the types of services you provide and how many people in your area offer the same service?

- What do you want to spend on marketing and other costs related to the promotion of your products?

- How much have you spent building up your company and what are your predicted running costs for each month moving forward?

- What makes your product unique from the rest of the competition and how much would your target audience value this feature?

- What is the best price you can purchase your goods from the supplier or manufacturer for?

Once you have been able to find evidence based research for the above questions, you can start thinking more clearly about where you want your price to sit using these two very important factors-

Return on Investment (ROI): of course you want your sales to yield a solid ROI, so think about what return of profit percentage you want to achieve on your investment. Usually this return of profit percentage can be spread out over a period of a few years. For example, you invest $200,000 into your company and want to make a 20% return on your investment within 2 years.

Profit Margins: now that you are aware of what it will take to get you a ROI plus your chosen percentage, you need to ensure that your products and services can sell for a decent profit. Work out what percentage profit you want to make on your products- perhaps it may even be helpful to work out the lowest percentage you would accept and then the highest that would be reasonable to give you a scale.

When looking at profits remember that you want to have some wiggle room to offer discounts, promotions and other factors that are going to help drive your sales, especially if you are just starting out.

It may also be worth noting that certain industries have common mark up percentages. For example, the traditional markup for hardware is usually 40 to 50 percent, whereas the traditional markup for the jewellery is usually 400 to 800 percent. You don’t have to follow these industry trends of course, but it may be worth noting what the typical markup price in your field.

Now that you have collected all of this information, it is time to talk strategies. While there is nothing wrong with coming up with your own system, here are the top four strategies that are currently being used for both goods and services:

Cost Pricing

The most popular strategy in the retail world is Cost Pricing. This is the simplest and most rational way to determine a price point as it requires you to calculate your direct and indirect expenses and then add your profit in order to get a price point. Just remember here to also factor in possible losses such as theft and damage in transit or shipping.

Competitive Pricing

This involves researching what your competitors are selling their products and services for and selling them at the same rate or even slightly lower. This strategy does not take into account the price you paid for the goods, instead it runs on the premise that by offering a cheaper or comparable rate, you can do more volume and therefore, make a solid return on your investment in the long run.

Market Value Pricing

This strategy looks at what the market can handle and then prices the goods and services at the highest end of the market scale. This strategy is commonly used for high end products or products that are unique and don’t really have much competition. The option can also be used to sell a service by an industry expert or a company that has a lot of clout.

Timed Pricing

This is usually adopted when you are offering a service or a non-material item and is usually an hourly or daily flat rate that is determined based on the types of services you are offering. The amount you charge is usually relative to expertise, demand and experience.

Choosing which strategy will best work for you will definitely depend on your business, however when it comes to settling on the perfect price point it may help to create a price line and different price points to give yourself a range.

Your Price Line and Price Points

Price points are the specific prices you choose within your determined price line. It is important to create a price line so you can determine which end of the scale you want your product to sit at. To do this, divide your price line into three sections: luxury, mainstream and budget.

The luxury section is of course the most you can charge for your goods or services without chasing your customers away. The mainstream section is a reasonable amount that is inline with competitors and the market rate and the budget sector is the lowest price you could charge that would yield you a ROI but still be cheaper than the competition.

Now that you have an understanding of your price points, it is important to finesse your final amount. Selling your product for $12.99 or $12.95 may not appear to make a huge difference, but psychology shows that people are attracted to different sounding and looking price points.

These price points are known as “charm prices” and subconsciously promote sales by making customers feel that they are spending less or getting a better deal.

A classic example of this is selling something for $99.99 versus $100. Time and time again, statistics have proven that people are less likely to buy rounded prices. In fact, sales increased by 24% in one study when prices were all rounded down by one cent.

Another example of this is pricing items written as $149.00 or $149, as studies show that the less numbers and the less complex the prices look, the less intimidating they are and the more likely customers are to purchase.

There was also the experiment conducted by MIT and the University of Chicago that found that when a women’s clothing item was tested at $34, $39 and $44, the $39 price point outsold the others every time. This was even despite the fact that the $34 price point was the lowest.

What does this show us?

In psychology, the number 9 has selling power and most retailers know this which is why most items in your local supermarket are priced with a 9 involved.

This may be something you need to test to see if it converts well with your business, but perhaps try starting out with a ‘9’ based number to see if it has any effect.

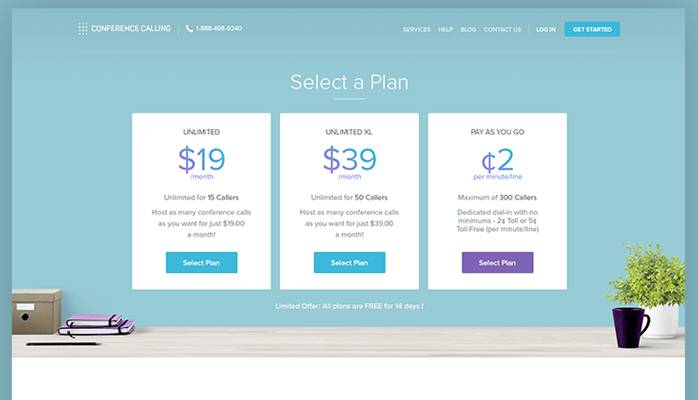

Another important factor to consider in price psychology is comparisons or anchoring where customers are presented with strategically presented price points in order to influence their decision.

Here is an example:

You are hungry and are looking to purchase a sandwich. Let’s say there are three different types of sandwiches in the shop for purchase. One is a cheese sandwich for $8.99, the second option is a chicken and cheese sandwich for $9.99 and the third option is a chicken, cheese, lettuce and mayo sandwich for $13.99.

As you can see, there is not much price difference between the 1st and 2nd options however, even though the second option is more expensive, it is a better deal. Therefore, the $9.99 price point is likely to outsell the $8.99 price point.

In this strategy, the cheapest item that offers the smallest value is only given a small discount compared to the mid-priced item (in the example given it’s only $1 cheaper) and the most expensive item is considerably higher to make the mid-priced item look better. This strategy is all based on getting people to spend a little more.

You can use this strategy in your brick and mortar business and in your online store to help increase conversions and test out different price points.

It is also worth noting that your price points are likely to change based on current market trends, supply and demand and the economy so you may also want to keep this in mind and review your price points at least every twelve months.

Pricing your items right can really make or break your business so really take the time to think about the perfect numbers that will not only attract and please customers but will also allow you to take your business to bigger and better heights.

Hey!

It looks like you're browsing in . Would you like to switch over to the website?